Sizing the opportunity

Non animal-protein ingredients are entering their golden age. After years of stand-by since their first appearance on the shelves of supermarkets – think of Quorn, the fungus-based meat already available in the ‘80 -, the sector is now booming.

It all started with Impossible Foods and Beyond Meat in the States. And now Nestlé, Danone, & C. are eventually following. Why? The simplest explanation is the generational change: New customers are now looking for two kinds of health, all together. Human health and the health of the Planet.

Catching and surfing this long-term trend is the main task that food companies should achieve. Quickly. Not only big businesses, but even the small ones (small shops and local food manufacturers) are in quest of non-animal/plant-based products.

Let’s have a look at Germany. Almost 70% of people there are estimated as flexitarians. And, in Europe, more than 12 M people suffer from intolerance to animal proteins. Moreover, there is a clear increase in demand for nutrition bars and sports drinks. Well, all these are just a few “weak signals†about where society is moving. And that the plant-based world is here to stay and not just a hype.

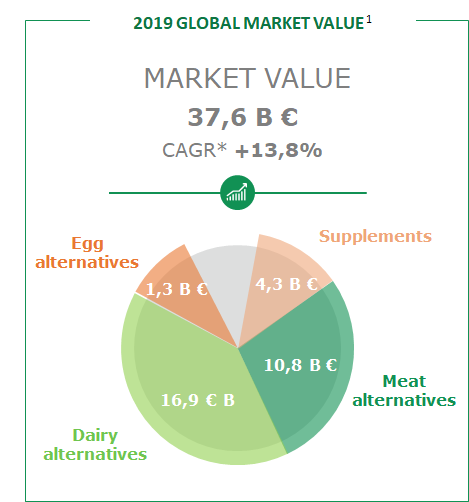

What about figures, then? How much  is it worth?

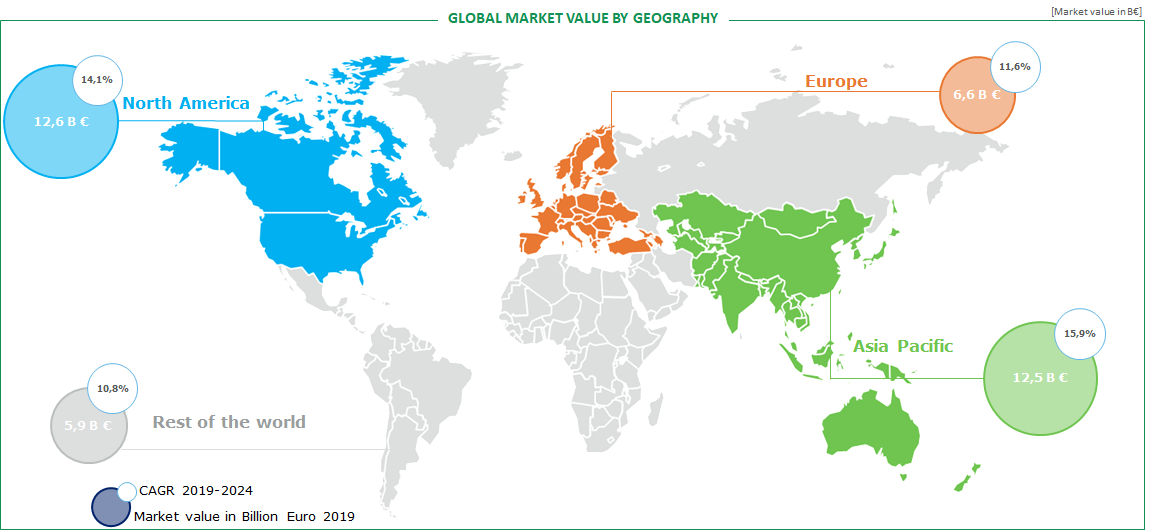

Let’s have a look at the world map. Today, there are two main markets almost equal in size for plant-based end products. North America and Asia-Pacific, were both roughly 12.5 B euros in 2019. Europe (Russia excluded) follows third, with 6.6 B euros. The Rest of the World represents less than 6 B euros.

What about market segments?

[1] Source: Plant Protein Market, Mordor Intelligence, 2019

At the global level, dairy alternatives were coming first in 2019 (market share: 16.9 B euros), followed by meat alternatives (10.8 B euros), dietary supplements, including sport bars and drinks (4,3 B euros). Egg alternatives were the smallest area of the pie (1.3 B euros).

This partly reflects the different timing of these products. Dairy alternatives are older than meat alternatives or egg alternatives (think about tofu), but also rooted in deeper needs and trends. Replacing milk is still a major pain point for many people. Replacing meat and eggs clearly are new trends. Egg replacements are still not seen as important as meat replacements, both because of perception (large meat consuming is already considered bad for health. This does not necessarily applies to eggs) and market structure (that’s easy to point at hamburgers in supermarkets, especially in the States).

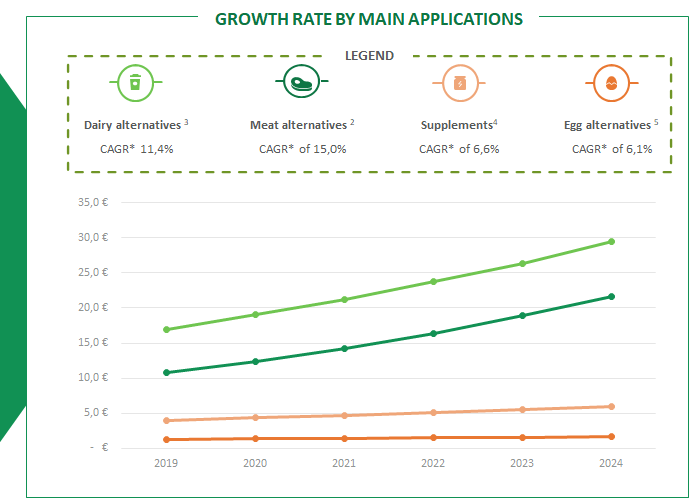

Interestingly, the picture from 2019 will look a bit different in 2024. Egg replacements and dietary supplements are likely to show a flat growth. Whereas meat alternatives will be the fastest growth area (CAGR 15 %). However, looking at sales, dairy alternatives will likely keep their first position, even though growing at slower rates than meat alternatives (11.4%).

In conclusion, we are really living in the Golden Age of plant-based products. When you think that, in all these products, protein ingredients can be in between 3 % to 25 – 30 % of the weight, you realize that the key for Food Companies is to identify the right ingredient for each application! Here is where Protilla helps, thanks to our in-house database and key enabling technologies.